Key Takeaways

- eKYC enables faster, more accurate, and remote identity verification using technologies like biometrics and AI.

- While it boosts access to financial services, it may exclude users without smartphones, internet, or a valid ID.

- Privacy concerns, data breaches, and AI bias remain major challenges in digital identity systems.

- The future of identity verification is moving toward decentralized models like SSI, giving users control over their personal data.

Introduction: A Shift in Identity

In a world where we unlock phones with our facial features and open bank accounts in minutes, identity verification has become more digital and vital than ever. The evolution of Know Your Customer (KYC) processes into seamless, tech-driven eKYC reflects a broader shift: security, speed, and inclusivity at the heart of digital transformation. But how did we get here, and where are we heading?

What is KYC, and How Did eKYC Emerge?

KYC, or Know Your Customer, is the process by which businesses, especially financial institutions, verify the identity of their clients. Traditionally, this meant physically collecting and validating documents like national IDs, utility bills, and proof of income. The goal? Preventing fraud, money laundering, and financial crimes.

eKYC, or Electronic Know Your Customer, is the digital evolution of that process. It allows identity verification to happen remotely using technologies like biometric recognition, document scanning, and secure APIs. Instead of queuing at a bank, users can now verify their identity in minutes, anytime, anywhere. This shift not only speeds up onboarding but also enhances accuracy, reduces operational costs, and widens access to financial services.

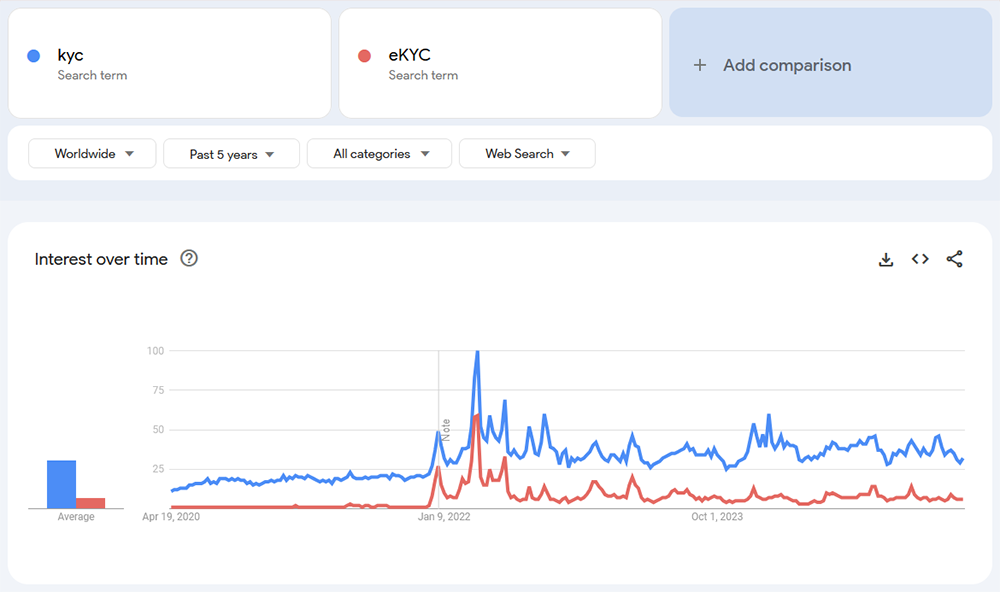

eKYC emerged as a trend in early 2022, as people began actively searching for it

The Paper Days: When KYC Was a Bottleneck

Before “e” entered the scene, KYC was synonymous with paperwork: photocopies of IDs, utility bills, and signatures scribbled on countless forms. This analog approach was slow, expensive, and error-prone. Customers often faced long onboarding processes, while banks bore the brunt of operational costs and compliance risks. Fraudulent documents and human error were frequent pitfalls, making identity verification more of a gamble than a guarantee.

The Digital Uprising: How eKYC Changed the Game

The rise of digital infrastructure, especially in mobile-first economies, set the stage for eKYC. Biometric IDs, digital wallets, and national databases gave institutions the tools to verify identities instantly. eKYC didn’t just speed things up; it revolutionized compliance. Automation reduced fraud risks, minimized data entry errors, and slashed onboarding costs.

Technologies such as OCR (Optical Character Recognition), liveness detection, and AI-based document verification made remote onboarding not only possible but preferable. Platforms could now verify users in real-time using facial recognition, behavioral biometrics, and multi-factor authentication, no branch visit required.

89% of corporate customers had a bad experience with KYC processes, to the point that 13% changed banks *

* Thomson Reuters

Driving Forces: Why the eKYC Revolution Took Off

Several factors accelerated this shift:

Regulatory Push

Financial regulators worldwide began encouraging digital KYC to combat money laundering and increase financial inclusion.

Fintech Disruption

Digital-native challengers pushed traditional banks to innovate or risk irrelevance.

Pandemic Catalysts

COVID-19 forced the rapid adoption of remote onboarding as physical interactions plummeted.

Tech Readiness

Advances in AI, blockchain, and cloud computing provided the backbone for scalable, secure digital identity systems.

Challenges & Questions: Is It All Smooth Sailing?

As digital identity systems evolve, so do the risks, often in unexpected ways.

Data Privacy & Sovereignty

With user information flowing across borders and into third-party platforms, questions arise about data ownership. In Europe, GDPR sets strict rules; in other regions, protections are patchy or outdated. Major data breaches, like those involving national ID systems, have exposed millions, raising alarms about centralized data repositories.

The Inclusion Paradox

Ironically, while eKYC aims to increase financial access, it can inadvertently widen the gap. Individuals without smartphones, stable internet, or formal ID documents can be excluded. For example, in parts of Sub-Saharan Africa, biometric systems struggled to enroll individuals with worn fingerprints due to manual labor.

Regulatory Gaps and Silos

Without harmonized global standards, banks and fintechs face complex, country-specific compliance hurdles. A solution compliant in Singapore may fail in the EU. This fragmentation hampers cross-border digital identity adoption, especially in trade and remittances.

Tech Bias and Ethics

AI-driven facial recognition often underperforms on women, darker skin tones, or older populations. A MIT study found error rates of over 30% for some groups, posing ethical challenges and compliance risks.

These are not merely technical issues—they’re human ones. And solving them requires more than code.

What’s Next: Decentralized ID and the eKYC of Tomorrow

The next wave of digital identity is being shaped by self-sovereign identity SSI (a digital identity model where individuals fully control their personal information) and decentralized ID systems. These approaches give individuals control over their data using blockchain and cryptographic tools. Imagine verifying your identity without ever handing over a copy of your ID—just a cryptographic proof of it.

eKYC will also become more predictive and intelligent. AI agents will analyze user behavior over time to spot anomalies, enabling continuous verification beyond a one-time check.

As the industry moves toward self-sovereign identity and intelligent verification, companies like Netiks are already paving the way by embedding seamless, secure eKYC processes into next-gen digital banking platforms.

Soon, onboarding may feel like logging into your favorite app: fast, intuitive, and invisible in the best way.

Conclusion: Identity in a Click

The journey from manual KYC to sophisticated eKYC systems reflects the digital age’s core value: trust, built at speed. As technology matures and global standards emerge, the dream of inclusive, secure, and seamless digital identity systems edges closer to reality.

For now, the evolution continues with each innovation, bringing us one step closer to a world where proving who you are is as easy as saying hello.

From paper trails to facial scans and beyond, the story of identity is far from over.