Empower Your Digital Transformation with Netiks OmniChannel Solution

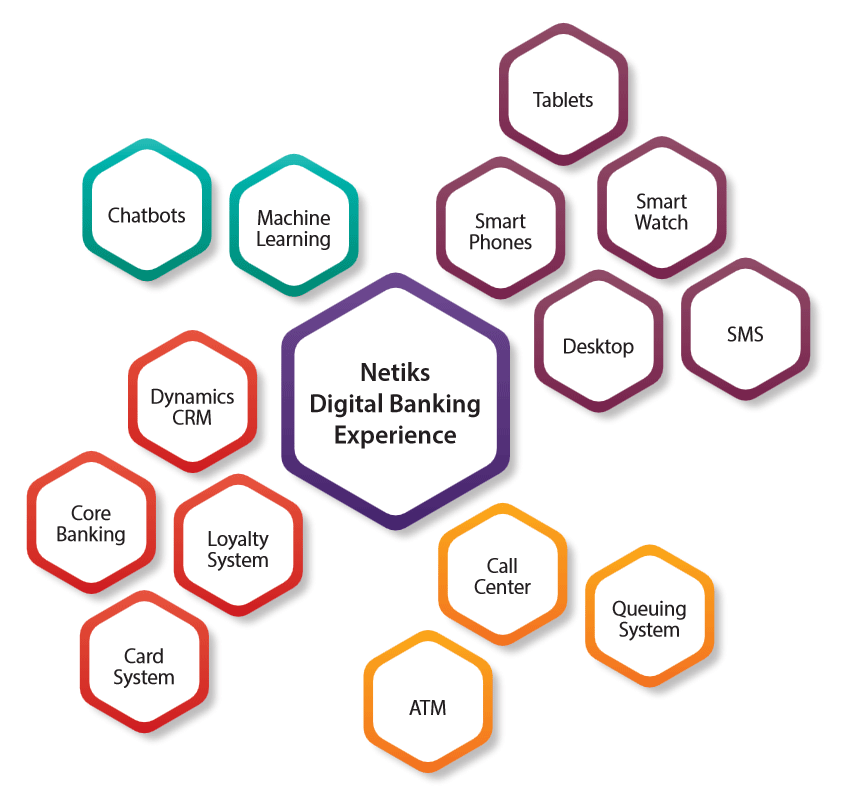

In the digital age, businesses are adopting a digital-first mindset, significantly transforming customer expectations. This shift is particularly evident in the banking sector, where traditional approaches are evolving with omnichannel banking software. Banks now leverage advanced digital solutions and AI-powered CRM to enhance the personalized customer experience.

OmniChannel banking, supported by CRM for financial services and customer relationship management tools like Microsoft Dynamics 365 CRM and Netiks 360Bank, elevates banking capabilities. By integrating AI recommendation engines, secure digital interactions, and CRM implementation services, banks can meet dynamic customer needs.

The Evolution of Customer Experience in Banking

The digital revolution has transformed banking, evolving customer behaviors and raising expectations. Financial institutions are now bridging online and offline banking with a digital-first approach, enhancing the customer experience.

Smartphone apps have become integral to retail transactions, making online sales and marketing crucial for financial institutions. Whether through bank branches, mobile apps, websites, or social media, personalized customer care is essential. An omnichannel banking software ensures a seamless, unified experience across all channels, with the customer at the center.

Utilizing CRM solutions like Microsoft Dynamics 365 CRM, AI-powered CRM, and banking CRM software such as Netiks 360CRM and Netiks 360Bank, banks can deliver advanced digital solutions. These tools provide AI-driven customer insights, sales automation software, and AI recommendation engines, all aimed at enhancing the personalized customer experience. Digital transformation tools, customer service software, and CRM for financial services are vital for secure digital interactions and business performance software, ensuring effective CRM implementation services.

Understanding OmniChannel Banking

OmniChannel banking transforms customer interactions compared to traditional multichannel approaches. Unlike multichannel's transaction focus, OmniChannel empowers seamless access across mobile apps, websites, call centers, and more. It synchronizes data, allowing customers to switch channels without redundancy. Imagine starting a conversation on one channel and effortlessly continuing on another without repetition.

OmniChannel banking not only enhances customer experiences but also revolutionizes back-office operations. It boosts marketing effectiveness, streamlines onboarding with AI-powered CRM like Microsoft Dynamics 365, and elevates client retention in banking CRM software. Explore advanced digital solutions for personalized customer experiences and secure interactions with Netiks 360Bank and 360CRM.

Why Choose an OmniChannel Banking Solution?

In today's digital era, customer interactions predominantly occur online, especially in banking. Customers have many options for their banking needs, from basic transactions to complex financial decisions like loans or investments. They extensively research services online, making informed choices critical.

An OmniChannel strategy enables identifying and guiding potential customers effectively. This data is invaluable, empowering sales and marketing teams to personalize their approach, offering tailored assistance and guidance. Research indicates that customers utilizing multiple channels are more likely to engage deeply with your products and services.

Moreover, OmniChannel solutions gather comprehensive customer data, providing insights that facilitate upselling through personalized communications. This approach leverages CRM solutions, AI-powered tools, and Microsoft Dynamics 365 CRM to enhance customer service, secure digital interactions, and drive business growth effectively.

The Advantages of OmniChannel Banking Strategy

As technology advances, customer expectations for seamless communication across multiple channels are higher than ever. Here's why OmniChannel banking is crucial:

- Lower Customer Acquisition Costs: In today's tech-driven world, delivering exceptional customer service is key. An OmniChannel approach ensures you're present across all relevant channels like digital and mobile banking, integrating them seamlessly. This reduces acquisition costs and boosts competitiveness.

- Enhanced Customer Experience: In banking, smooth communication across channels is essential for trust and satisfaction. OmniChannel banking ensures a cohesive customer journey, making it easier to manage financial interactions securely and efficiently.

- Optimized Sales: Whether handling inbound inquiries or proactive outreach, OmniChannel strategies increase touchpoints and improve interaction quality. This leads to better sales outcomes and quicker customer feedback.

- Faster Issue Resolution: Customers often switch channels seeking support, which can lead to frustration. OmniChannel banking records every interaction, minimizing repetition and speeding up issue resolution.

-

Streamlined Agent Efficiency: Assigning each customer a dedicated agent streamlines support, aided by automation for routine tasks. This allows agents to focus on meaningful customer interactions.

- Actionable Insights: OmniChannel banking leverages data analytics from online transactions and interactions to enhance service delivery and target marketing efforts effectively.

By adopting an OmniChannel approach with advanced digital solutions like Netiks 360Bank, banks can optimize customer experiences, reduce costs, and drive business growth.